Trading indicators are widely used by traders to analyze trading signals. Of the many trading indicators, traders usually only choose a few indicators to use or combine. So, what are the most accurate trading indicators that can help traders make good trading strategies? Here’s a list of the most accurate trading indicators according to experts.

Moving Average (MA)

One of the most accurate trading indicators is the MA indicator. According to the Investopedia Team, MA is an overlay type of technical indicator. An overlay indicator is a type of indicator that plots prices on the same scale as the asset price chart on the market.

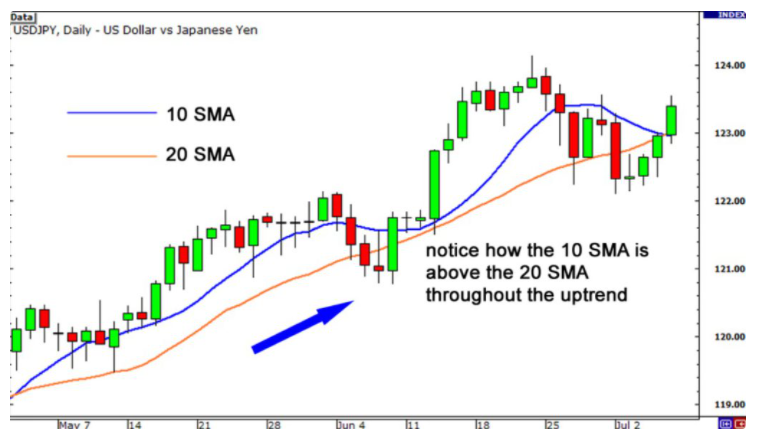

Rakesh Upadhyay from Cointelegraph revealed that MA is one of the most accurate bitcoin trading indicators to identify asset momentum. Among the four types of MA indicators, the SMA (Simple Moving Average) and EMA (Exponential Moving Average) are the most popular.

Read Too :

- Premium Binary Bot Free Downloads – Higher Lower Bot 2022

- Binary Bot XML – G7 Analyzer Digits Over Under Bot 2022

- Binary Trading Bot Downloads – No martiangle PUT CALL 2022

- Digit Differ Bot Free Downloads – Differ Twin XX YY Wih Martiangel 2022

According to Rakesh, EMA is suitable for short-term trading because it tends to respond to price changes quickly. Meanwhile, SMA is more suitable for trading in the longer term because it is relatively slow to respond to prices. The period that is often used is the 20-day EMA and the 50-day SMA.

Relative Strength Index (RSI)

The RSI is one of the most accurate indicators for crypto trading. In addition to MA, Rakesh called the RSI the best indicator to see the momentum of changes in the price of bitcoin. Short-term traders use the 5 or 7-day RSI, while long-term traders can choose 21 or 30 periods.

Another function of the RSI is to spot trends and divergences which provide traders with trend reversal signals. RSI has an oscillator scale with a value range of 0-100. A reading below 30 is referred to as oversold and above 70 is considered overbought.

Read Too :

- Premium Binary Bot Free Downloads – Higher Lower Bot 2022

- Binary Bot XML – G7 Analyzer Digits Over Under Bot 2022

- Binary Trading Bot Downloads – No martiangle PUT CALL 2022

- Digit Differ Bot Free Downloads – Differ Twin XX YY Wih Martiangel 2022

Moving Average Convergence Divergence (MACD)

Troy Segal from Investopedia calls MACD one of the most accurate forex trading indicators to confirm buy and sell signals. This indicator consists of a histogram and an exponentially moving average of prices.

Troy added that the most accurate indicator for forex trading is the most popular and useful trend confirmation tool. Reporting from the Elearnmarkets page, a regular divergence between MACD and the price of a crypto asset signals a price reversal, while a hidden divergence indicates a continuation of the trend.

Stochastic Oscillator (OS)

According to Lakshman Prabhu of Coinmarketcap, OS is an indicator developed to measure price momentum and speed. The Investopedia team included it in the list of the 7 best technical indicators in the world of trading that can be used to make technical analysis by looking at the overall price trend.

Cory Mitchell from The Balance revealed that the indicator developed by George Lane in the 1950s was used to see overbought and oversold levels. Values above 80 are considered overbought, while values below 20 are considered oversold.

Read Too :

- Premium Binary Bot Free Downloads – Higher Lower Bot 2022

- Binary Bot XML – G7 Analyzer Digits Over Under Bot 2022

- Binary Trading Bot Downloads – No martiangle PUT CALL 2022

- Digit Differ Bot Free Downloads – Differ Twin XX YY Wih Martiangel 2022

Bollinger Bands (BB)

Troy Segal from Investopedia said BB is the most accurate trading indicator that functions as a profit taking tool. According to Adam Hayes of Investopedia, this technical indicator developed by John Bollinger is defined by two standard deviation trend lines plotted alongside the trend SMA of the asset.

Cory said that the midline of the BB indicator will show overbought and oversold levels, provide information about volatility, and show price trends as a consideration for traders to take profits.

That’s the list of the most accurate trading indicators according to experts. However, Rakesh emphasized in his writing on Cointelegraph that there is no perfect indicator that is suitable to be applied in all market conditions. It is simply a matter of the trader’s preference in choosing an indicator that suits their trading style and market conditions of their asset.

Rakesh added that traders can use a combination of several indicators to confirm the signals that appear within the relevant timeframe are correct. However, it should also be noted that in some cases, using too many indicators can make traders feel overwhelmed and make it difficult to make decisions.

Read Too :

- Premium Binary Bot Free Downloads – Higher Lower Bot 2022

- Binary Bot XML – G7 Analyzer Digits Over Under Bot 2022

- Binary Trading Bot Downloads – No martiangle PUT CALL 2022

- Digit Differ Bot Free Downloads – Differ Twin XX YY Wih Martiangel 2022