The foreign exchange market, or forex (FX) for short, is a decentralized market that facilitates the buying and selling of various currencies. Where transactions occur over the counter, Over The Counter (OTC) through the interbank market, not on a centralized exchange.

Without us knowing it, we are already participating in the foreign exchange market, perhaps by buying imported shoes. Or even a real example is when we exchange foreign currency when we are going on vacation abroad.

What is Forex? Forex Trading Explanation

Some of the reasons why many traders are interested in forex, among them:

- The breadth of the Forex market

- A variety of currencies that can be traded

- The level of volatility is quite diverse

- Low transaction fees

- Trading time for 24 hours during the week

This article will be useful for traders of all levels. It doesn’t matter whether you are new to forex trading or want to improve the knowledge you already have. Through this article, we seek to provide a solid foundation for the forex market.

Forex Market Explanation

In short, this forex market works like any other market in general, both in terms of supply and demand. For example, if demand for US Dollars is strong from European residents as Euro holders, they will convert Euros into Dollars. The value of the US Dollar will rise while the value of the Euro will fall. Please note that this transaction only affects the EUR/USD currency pair and will not affect any other currency. For example, the USD depreciates against the Japanese Yen.

Forex Market Movers

In reality, the example above is just one of many factors that can move the forex market. Other forex market drivers, including macro-economic reports such as interest rate reports, GDP data, unemployment data, inflation data and reports on GDP to debt ratios. Elections for a new president, or country-specific factors can also play a role.

Experienced traders use the economic calendar to be up to date with important economic releases that can move the market.

What Makes Forex So Attractive?

The forex market allows large institutions, governments, retail traders, and private individuals to trade one currency for another. And this continues to take place through the interbank market (between banks).

The benefit of forex trading between global banks is that the forex market can be traded around the clock during the week. As the Asian trading session neared the close, European and British banks started operating before continuing to activity in the US. While the trading time of the day is closed at the end of the US trading session. However, it was just hours before the Asian session opened for the next day’s session.

What is Forex? Forex Trading Explanation

What makes this market even more attractive to traders is that the forex market is the most liquid market in the world. With an average daily trading volume of $5.1 trillion according to the 2016 BIS Triennial Survey, this means that traders can easily enter and exit their trading positions because there are many buyers and sellers who are constantly active in the market.

What is Forex Trading and How It Works

Many people wonder how to make money trading forex. Fortunately, the basics behind forex trading are pretty straightforward. If you think the value of a currency will go up, you can buy that currency. This term is known as a Long or “long” position. On the other hand, if you feel that the currency will decline or depreciate, you can sell the currency. This is known as a short position or “short”.

Who Trades Forex

There are basically two types of traders in the forex market: hedge traders and speculators. Hedgers always try to avoid extreme movements in exchange rates. Think of large conglomerates like Exxon and how they reduce their exposure to foreign currency movements.

On the other hand, speculators seek risk and are always looking for volatility in exchange rates to take advantage of. This includes large trading desks at major banks and retail traders.

Reading Forex Price Quotes

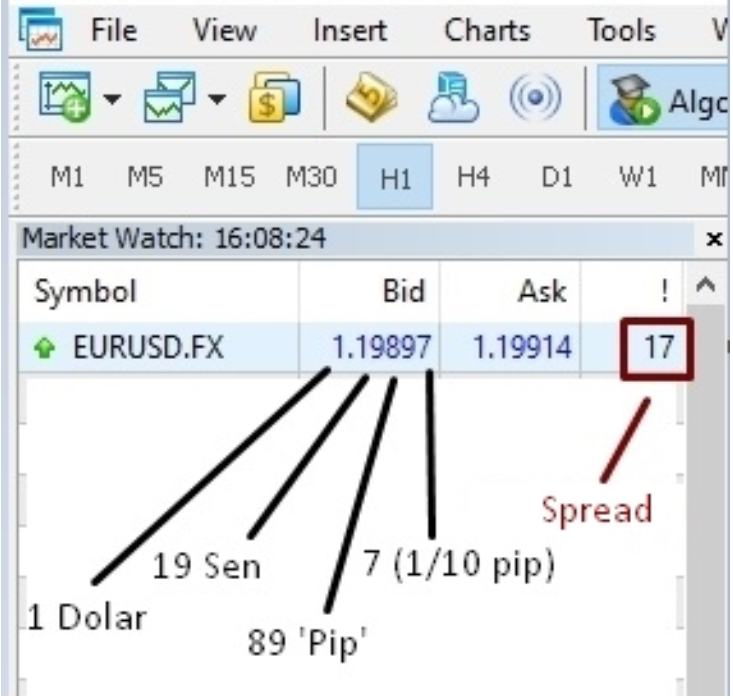

All traders need to understand how to read quotes or quotes or forex quotes. Because, this will determine at what price traders enter and exit trades. To read a currency quote, for example the EUR/USD currency pair, the first currency is known as the base currency, namely the Euro. The second currency in the pair (USD) is known as the variable or quote currency.

For most of the forex market, the quoted price is up to five decimal places, but the first four decimal places are the most important numbers. The number to the left of the decimal point indicates one unit of the variable currency. In this example, it is USD and therefore $1. The following two digits are cents, so in this case 13 US cents. The third and fourth digits represent fractions of a penny and are referred to as pips.

It is important to note that the number in the fourth decimal place is known as a ‘pip’. If the EUR weakens against the USD by 100 pips, the new selling price will reflect a lower price of 1.12528 because it will be cheaper in USD to buy 1 Euro.

What is Forex? Forex Trading Explanation

Why trade Forex?

The reasons why you should trade forex, will be explained below:

- Low transaction fees: In particular, forex brokers make money from spreads on positions opened and closed before incurring a stay fee on open positions. Therefore, forex trading is cost-effective when compared to other markets such as equities, which charge a commission.

- Low spreads: Unbelievably low spreads or price differences between Bid/Ask for major currency pairs due to their liquidity. When trading, the spread is the initial hurdle that needs to be overcome when the market moves in your favor. Every additional pip that moves in your favor becomes pure profit.

- Greater opportunities for profit: Forex trading allows traders to take speculative positions on currencies that are strengthening or appreciating and those that are falling or depreciating. Furthermore, there are many different currency pairs for traders to make profitable trades.

- Leverage trading: Forex trading involves the use of leverage, or leverage. This means that a trader does not need to spend large funds to trade but only needs to place a small amount of funds. This has the potential to increase your profit opportunities even though the loss opportunities are also large. We, JavaFx strongly require discipline in our approach to risk management by limiting their effective use.

Learn Forex Trading Terms

Base currency: Is the currency that appears first or is on the left when quoting a currency pair. For example, EUR/USD, Euro being the base currency.

Variable/Quoted Currency: Is the second currency in the quoted currency pair. In the EUR/USD example, the US dollar is the quote currency.

Bid: The bid price is the highest price a trader should be prepared to execute. When you are about to take a short position, this is the price you will get. It is usually in the left position and is generally colored red.

Ask: opposite the bid, and represents the lowest price a trader in a short position would receive. When you will open a buy/buy position this will be the price you will get. The ask price is usually on the right side in blue.

Spread: Is the difference between the bid and ask prices that represents the actual difference in the underlying forex market. Generally this spread is also included with the additional difference added by the broker.

What is Forex? Forex Trading Explanation

Pips/points: a pip or point refers to a single digit move in the 4th decimal in MT4 and the 5th decimal in MT5. This is often a trader’s way of showing movement in a currency pair, for example, EUR/USD strengthened 100 points today.

Leverage: Leverage allows a trader to open a trading position by placing only a fraction of the full value of the trade that is supposed to be. This allows the trader to oversee larger positions with less capital. Leverage affects as much as profits and losses.

Margin: Margin Is the amount and amount of capital required to open a leveraged position and is the difference between the full value of your position and the funds lent to you by the broker.

Margin call: is when the total deposited funds, plus or minus the profit or loss, falls below the specified level or the required margin.

Liquidity: is how easy it is for a financial asset to be converted into cash. The forex market is the most liquid market, because we can open and close trading positions very easily.