When the stock market drops sharply, and then rebounds, many traders eagerly enter the market. The hope is big profit. But keep in mind, that the rebound that occurs is not necessarily real, it could be a hoax. There is a term that market participants need to know, namely Dead Cat Bounce. What does it mean? How to recognize it?

What is Dead Cat Bounce?

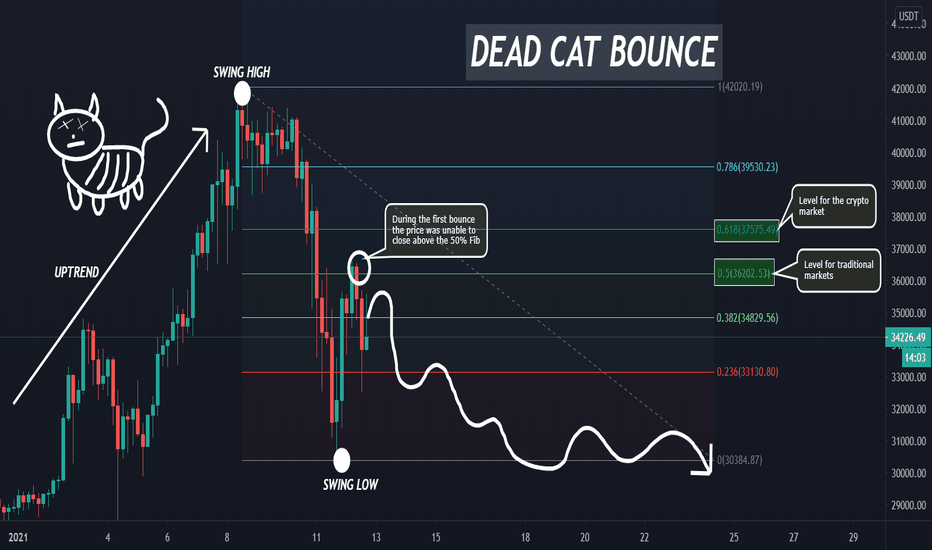

Dead Cat Bounce or often abbreviated as DBC is a term that refers to a temporary increase in the index or stock price in the middle of a downward phase. Dead Cat Bounce is just a temporary rally that does not indicate a reversal from the downtrend phase. After the Dead Cat Bounce occurred, the price fell again.

The term dead cat bounce comes from the understanding: when it falls from a very high place, even a dead cat can bounce.

Example of Dead Cat Bounce

When the JCI fell due to Covid-19 in 2020, there was a Dead Cat Bounce, then it fell again.

Dead Cat Bounce 2

What Are the Risks of Dead Cat Bounce?

Dead Cat Bounce is often referred to as the “sucker’s rally.” This means he will trap the unwary “dumb trader”. The risk is of course, after Dead Cat Bounce there is a further and often sharper decline.

Read Too :

- Premium Binary Bot Free Downloads – Higher Lower Bot 2022

- Binary Bot XML – G7 Analyzer Digits Over Under Bot 2022

- Binary Trading Bot Downloads – No martiangle PUT CALL 2022

- Digit Differ Bot Free Downloads – Differ Twin XX YY Wih Martiangel 2022

What Causes Dead Cat Bounce?

Dead Cat Bounce is usually caused by several things:

- There are market participants who cover short (take profit on short positions)

- Some market participants feel the market has fallen deep enough and make purchases.

- Some investors make purchases because they find stocks that are oversold (considered cheap)

How to Detect Dead Cat Bounce?

It is difficult to determine whether the bull run in the market is a Dead Cat Bounce or a real reversal. Because basically the market is difficult to predict. But there are a few things to watch out for to detect Dead Cat Bounce:

- Temporary increases are usually not very sharp. Slightly sloping

- The transaction volume is usually lower than usual, because the sentiment of market participants is still negative, only a few market participants are willing to buy

Read Too :

- Premium Binary Bot Free Downloads – Higher Lower Bot 2022

- Binary Bot XML – G7 Analyzer Digits Over Under Bot 2022

- Binary Trading Bot Downloads – No martiangle PUT CALL 2022

- Digit Differ Bot Free Downloads – Differ Twin XX YY Wih Martiangel 2022

Conclusion

A downtrending market is no fun. The market will toy with your emotions by tempting you for short-term gains. You can feel compelled to enter, and it turns out to be slack. If you are a trader, the key is to figure out the difference between a dead cat bounce and a real reversal.

I hope this article inspires you.